Returns are now part of the holiday gift giving season. According to the National Retail Federation, up to 55 percent of consumers plan to return or exchange unwanted gifts. A survey by an industry leader shows that up to 73 percent of consumers shop with returns in mind. These predictions are becoming reality, with a major parcel provider handling 1.9 million return packages on one day, Jan. 2. The provider said this is, an increase of 26 percent from a year ago.

E-commerce is being identified as one factor in the increase in returns. Consumers have come to expect to get what they want, when and how they want it, at no extra charge. These same consumers also expect the return process to be easy and convenient as well, a goal that many retailers and manufacturers are actively working to accommodate. Companies are, extending the date for returns to be accepted and requiring less paper work or packaging. For some items, a return can be as simple as dropping the item off.

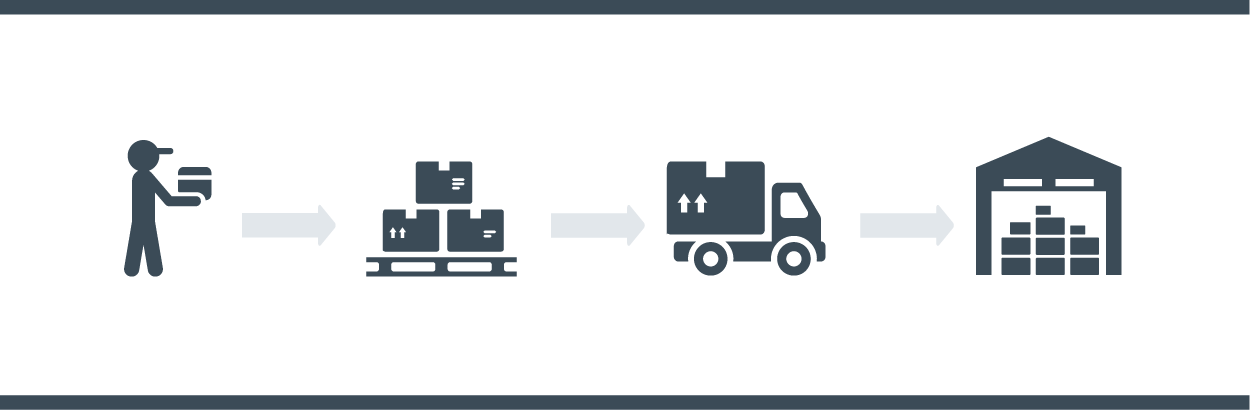

But what happens after a return item is shipped? At this, the complexity, extra work and added costs are experienced. Here are some of the most common impacts of returns on supply chains.

Warehouse build-up

Warehouses experience huge back logs of packages from being inundated with returns, especially after peak season. There is always an emphasis on staffing for peak season, but if you don’t have enough staff after this time, the build-up trickles downstream, impacting demand planning and inventory optimization.

Today’s consumers expect to be refunded for returns almost immediately after shipping their orders back, and supply chains have accommodated them. The minute a return label is scanned into the returns cycle, customers are issued their credit. Once the credit is issued, packages sit idly for extended periods before making their way back into inventories, causing a disconnect in planning. Retailers may think inventories are low when, they haven’t factored in returned items that haven’t made their way back into inventories. This causes companies to order more products than they need.

Specialized distribution centers (DC’s)

Not every DC serves as a return center. While it may ship out large quantities of product, the DC may not have the capacity to handle all, or any, of the associated returns.

Companies have begun to identify core return centers across geographical regions, so only 2-3 locations are affected by returns, as opposed to the overall supply chain. Supply chains must continue to identify optimal return centers to streamline the process, increase efficiency, and exceed customer expectations. The only potential for negative impacts on customer relations is if they don’t receive their credit, so immediately issuing the credit is key to avoiding animosity.

Increased need for advanced analytics

Consumers don’t bat an eye at ordering multiple of the same product in different variations, such as clothing and shoes in numerous sizes and colors, returning the versions they don’t want. According to some sources, size causes more than half of all returns, and repeat offenders are much more likely to partake in this type of shopping online versus in store.

Forecasting returns is much more difficult than forecasting sales, which makes it almost impossible to factor into planning. This opens the door for solutions like predictive analytics to be integrated into forecasting processes. Predictive analytics can give insight into the volumes of historical data collected, helping companies identify patterns on which items are typically returned from multiple orders.

The emergence of new return options

The day is coming where you will no longer have to take packages to parcel provider offices or locations to have them returned. New players in the market are likely to continue to diversify their fleets’ capabilities and provide new, more convenient options.

Return stations to drop packages will likely pop up in high volume locations, like shopping centers, and some providers will even pick up packages right from your home. Returns-focused companies are also emerging to reshape the returns process while increasing sales, profits, and sustainability for retailers.